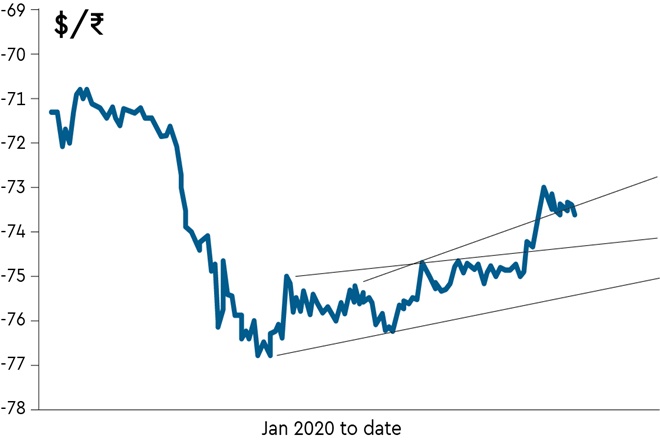

The rupee broke above 74 to the dollar towards the end of August and has been hovering in the 73-74 range since then, with a strengthening bias. Indeed, it flirted with 73 and, absent RBI action, it likely would have breached that level a couple of times so far.

Interestingly, the rupee started strengthening just as FPI inflows slowed down—since mid-August, the 7-day average of inflows has fallen from 585 million a day to near zero. During this period, the rupee strengthened by 2%, in the process breaking above RBI’s earlier protected level of 74.50. The driver for this was clearly that the market was getting increasingly concerned about inflation, reflected in the devolvement of three RBI auctions and rising yields. It would seem that this pushed RBI to loosen its ceiling for the rupee, perhaps in the hope that a stronger rupee may help contain inflation at least a little bit.

Many analysts see the uptick in inflation as temporary, as it is driven by supply constraints during the lockdown, and RBI may be counting on that. However, the noise on the ground indicates that inflation expectations are rising and it is critical not to allow these to get entrenched. In all likelihood, supply constraints will ease, but a good monsoon and, hopefully, a sane government second package that puts money in peoples’ hands could see the demand side of the inflation picture come into play. This suggests that it will be difficult for RBI to cut rates in the immediate future.

The trade figures for July just released show that imports are still nearly 30% down from last year; exports are also lower by 20+%, confirming that our recovery is slower than most of the rest of the world. This points out that the trade picture continues to fundamentally support the rupee. The larger issue is that the currently high bond yields multiplied several times by the Fed’s open tap approach (which would broadly make emerging market assets more attractive) could see FPI flows pick up over the next few weeks. While the stock market will love this, it would also make it harder for RBI to hold the line at 73, particularly as the huge amounts of rupee liquidity already in the system would make it that much more difficult for RBI to sterilise the inflows.

On the other hand, there is also increasing talk that the government and RBI may reach an accommodation on monetising any fresh support package—this would calm bond markets since this would manage its concerns about the still-to-come supply of government bonds. If yields were to fall back under this monetary management, we could see the rupee pause, and perhaps slip back towards—and, possibly, above—74.

Of course, in the larger scheme of things, these are minor movements. Exporters, who celebrated near-77 levels, are likely ruing that they did not hedge significant amounts—the forward rate for December has fallen by more than 5% since the rupee’s plunge. But, the truth is that when the rupee is falling, it always looks like it will be better tomorrow—but that tomorrow never (or seldom) comes.

Tragically, many exporters are still waiting and watching. It is always possible that the rupee could again tank—if, say, the global markets tank—but a bird in the hand is worth (often much more than) two in the bush. With premiums still around 4% a year, exporters should ensure that they are never more than half exposed; in fact, we would recommend a structured process with a stop loss in place to ensure that a certain minimum value is achieved irrespective of what happens to the market. Following this kind of approach—where a certain amount is hedged upfront, and a stop loss is set to protect against a bad market—would have resulted in a fully hedged rate of 77 for December exports (assuming the position was set in mid-April when the rupee was at its low) as compared to about 74.50 today.

Importers, of course, are enjoying the seemingly free ride. But, we all know that when the rupee turns, it is vicious. To my mind, it is worth paying as much as 50 paise for insurance—thus, I would certainly, hedge at least 50% of import exposures out to two months AND, critically, set a risk limit of, say, a further 50 paise, so, if the rupee turned sharply, I would hedge some more if/when the spot hits 74.

The author is CEO, Mecklai Financial

Views are personal

http://www.mecklai.com