Though taxes are around 100% of the ‘base price’ of petrol or half the retail price (the case of diesel is comparable) and both the Centre and state governments treat the two auto fuels as a milch cow, it is only the states that benefit from a spike in their prices. Since the Centre’s excise duty on petrol and diesel are specific (quantity-wise), rather than ad valorem, it could, if at all, only lose revenue if prices skyrocket in sync with the global trend and hit consumption levels. The state governments, on the other hand, tend to gain immensely when prices soar thanks to the ad valorem value-added tax (VAT), sales tax, and additional cesses/surcharges levied by them on these fuels.

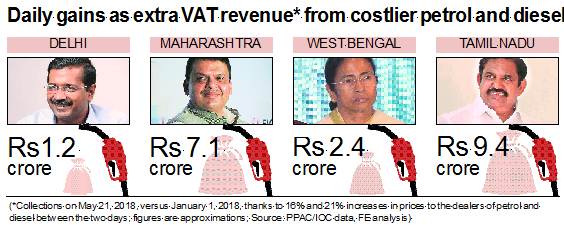

According to an FE analysis, even the small Delhi government raked in an additional Rs 1.2 crore a day on Monday from taxes on petrol and diesel alone, compared with what it fetched on January 1 this year. This is because the base price or price to the dealer of petrol and diesel were higher by 16% and 21% on Monday from their respective January 1 levels. The corresponding figures for the bigger states are naturally higher (see chart).

Curiously, not only the Opposition parties but even industry associations are putting pressure on the Centre, rather than states, to cut taxes on auto fuels given the recent surge in their prices (Indian basket of crude went up 12.4% between May 1 and Monday and the rupee has depreciated 2.2% against the US dollar in the period, resulting in near-corresponding increases in domestic fuel prices). Ficci said on Monday, “…there is a scope of bringing down the excise duties. While such a move will have an implication on the fiscal revenues at this juncture, there is a need to do the fine balancing act.”

State VAT is generally levied on the price charged to the dealers by refiners inclusive of the excise duty; dealer commissions is included in the VAT-able price by some states.

While central excise duties remained static at Rs 19.48 per litre on petrol and Rs 15.33 per litre on diesel since October last year when these taxes were cut by Rs 2 per litre, the state-level taxes have virtually risen in tune with the fuels’ price increases. While four states — Maharashtra, Gujarat, Madhya Pradesh and Himachal Pradesh — reduced VAT rates following the October excise cut by the Centre, higher prices ensured that even their revenues were not only quickly restored but went up.

Of course, the Centre too levies an ad valorem excise on aviation turbine fuel, but there has been little political storm over it.

FE relied on the Petroleum Planning and Analysis Cell’s (PPAC) petrol and diesel consumption data for FY18 to compute the daily consumption of the fuels in the four select states — Delhi, Maharashtra, West Bengal and Tamil Nadu. (These states were selected since historical fuel price data for only these are officially put out.) While the PPAC data on share of these states in the domestic consumption of all petroleum products are available, we assumed that they may have a similar share in the consumption of petrol and diesel as well and arrived at these fuels’ daily consumption levels in these states. Given the ad valorem VAT rates prevailing in these states and the retail fuel prices on the two days, the VAT incidence (Rs/litre) for both days were estimated. Assuming the consumption to be the same on both days (petroleum consumption is almost price-inelastic and consumption doesn’t differ much in such short periods), the tax collections on both days and the differences too were calculated.

CARE Ratings said in a recent report; “In FY17 Rs 4.63 lakh crore was collected by the government through various taxes and levies with the Centre accounting for 62% of the total. For the Centre during FY17, 89% of the total came from excise duties and the balance from crude oil cess and customs. For the states during FY17, 88% of the total came from state VAT levied on POL (petroleum, oil and lubricant) products and the balance from royalties, crude oil cess, octroi and duties. Maharashtra contributes 14% (highest) towards the state-wise collection of sales tax/VAT on POL products.”

While, as Subhash Chandra Garg, secretary, department of economic affairs, said recently, the higher crude prices won’t impact the Centre’s fiscal deficit much, it could have implications for the current account deficit and inflation.

Petrol has a weight of 2.18% and diesel 0.14% on the consumer price index. “Our model estimates suggest that $10/bbl increase in oil price will increase import bill by around $8 billion. This in turn will decrease GDP by 16bps, increase fiscal deficit by 8bps, CAD by 27bps and inflation by 30bps,” SBI economists said in a report.