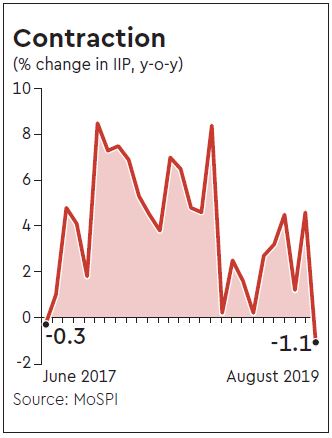

Industrial production in August shrank 1.1%, the worst contraction in 81 months and the first since June 2017, suggesting the supply side is adjusting itself to the acute demand compression in the economy and dampening hopes of an industrial recovery anytime soon to prop up faltering GDP growth.

What compounds the worry is that the slowdown is broad-based (manufacturing and electricity contracted while mining barely grew) even at a time when companies usually stock up to cater for festive demand.

The data released by the Central Statistics Organisation on Friday showed capital goods output contracted as much as 21% in August — the worst show in the current series (since April 2012) — and recorded its eighth straight month of fall, albeit on an unfavorable base. This suggests a collapse in investments and a revival is unlikely to be easy and quick despite a massive corporate tax cut recently.

The contraction in consumer durables output just worsened to 9.1% in August, against a fall of 2.7% in the previous month, mirroring the drop in sales of automobiles, among others, and indicating persisting weakness in urban demand.

Growth in consumer non-durables output less than halved sequentially to just 4.1% in August from as much as 8.4% in July (which was the highest since October 2018).

Similarly, the growth of intermediate goods, a key driver of industrial production in recent months, plunged to 7% in August, from 14.7% in July and emerged as one of the biggest contributors to the sequential slowdown in the latest IIP.

Since inflation is expected to remain within the central bank’s target of 4%, the monetary policy committee may be tempted to cut the repo rate again in December (for a sixth time in 2019), given its accompodative stance and tilt towards supporting growth. The RBI last week cut its FY20 GDP growth forecast for the country by a sharp 80 basis points to 6.1%.

Manufacturing shrank 1.2% in August, the worst performance since October 2014. Mining rose just 0.1% in August, against 4.8% in the previous month, while electricity output contracted 0.9% against a rise of 4.8%in July.

Aditi Nayar, principal economist at ICRA, said: “With the worsening in the performance of Coal India and electricity generation, and the continuing deep contraction in auto production in September, it appears unlikely that the decline in the IIP in August will be reversed in September.” She ruled out a meaningful recovery in GDP growth in the second quarter and added that the extent of pick-up in consumption in the festive months and rabi crop output will signal whether a material turnaround in demand and economic growth are in the offing.

DK Pant, chief economist at India Ratings, said in the two-digit classification, 15 out of 23 groups witnessed contraction. “It appears pre-stocking due to festive demand (in September and October) hasn’t taken place.”