Between October and December, every day was a new day for Bitcoin. Each day it surged to a new lifetime high and became one the most sensational things that got the world talking — some for tapping its potential; some to discredit it. But a day came when it fell from its life-time high of $19,000 in mid-December, and continued tumbling for next five months, easing over 50% of its gains. The biggest reason for Bitcoin’s fall could be Bitcoin itself — Bitcoin Futures.

Yes, behind the fall of Bitcoin could be Bitcoin Futures, a report by Federal Reserve of San Fransico has said. “The rapid run-up and subsequent fall in the price after the introduction of futures does not appear to be a coincidence,” the report ‘How Futures Trading Changed Bitcoin Prices’ said.

“The advent of blockchain introduced a new financial instrument, bitcoin, which optimistic investors bid up, until the launch of bitcoin futures allowed pessimists to enter the market, which contributed to the reversal of the bitcoin price dynamics,” the report added.

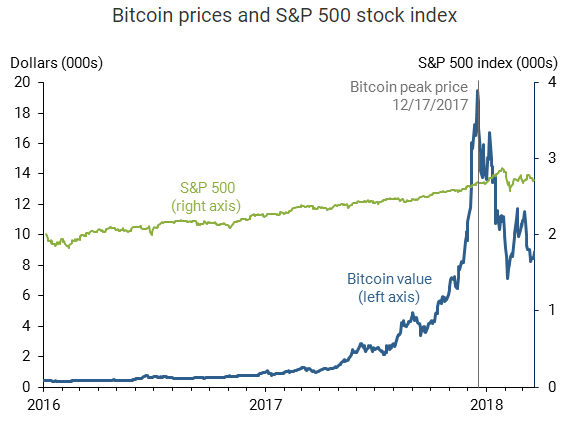

Founded by an unknown person or a group of persons Satoshi Nakamoto in 2009, Bitcoin remained within $4000 until mid-2017, when it increased exponentially for about 10 months. “This explosive growth ended on December 17, 2017, when bitcoin reached its peak price of $19,511. Notably, these dynamics aren’t driven by overall market fluctuations,” the report said.

With the introduction of bitcoin futures, pessimists could bet on a bitcoin price decline, buying and selling contracts with a lower delivery price in the future than the spot price, which may have led to the fall in Bitcoin price. This was consistent with the rise and collapse of the home financing market in the 2000s, which also allowed pessimistic investors to bet against it later.