In what can be termed as the second big deal during the current year in the offline consumer space, Aditya Birla Fashion and Retail (ABFRL) on Friday announced a strategic partnership with Walmart-backed Flipkart Group, wherein the latter will pick up a 7.8% stake in the former for Rs 1,500 crore by way of a preferential issue on a fully diluted basis.

The company has also, in furtherance of the existing business-to-business arrangements with Flipkart India, entered into a commercial agreement in relation to the sale and distribution of various brands of the company.

In August, Reliance Industries’ unit Reliance Retail Ventures had acquired retail and wholesale business and the logistics and warehousing business from the Kishor Biyani-promoted Future Group as going concerns for a lumpsum amount of Rs 24,713 crore.

ABFRL will use the capital to strengthen its balance sheet and push growth. It plans to scale up its play in emerging high-growth fashion categories and establish them as the new engines of growth for itself. Further, it will accelerate the execution of its large-scale digital transformation strategy that will deepen its consumer connect and augment its back-end capabilities and position itself as a comprehensive omni-channel fashion player. The promoter and promoter group firms of ABFRL will hold about 55.13% upon completion of the issuance. Post-completion, ABFRL would have successfully executed a capital raise of Rs 2,500 crore since April 1, 2020, the company said in a statement.

As part of the deal, 7,31,70,732 fully paid-up equity shares, at a price of Rs 205 per share will be issued to Flipkart Investments.

The investment agreement provides for preemption rights and right of first refusal which are for a limited period of between one and five years from the date of allotment of equity shares or if the equity shareholding of the investor falls below a certain threshold. The investor (Flipkart) is also entitled to appoint an observer as an invitee to the board, subject to defined shareholding threshold.

Commenting on the transaction, Kumar Mangalam Birla, chairman, Aditya Birla Group, said, “This partnership is an emphatic endorsement of the growth potential of India. It also reflects our strong conviction in the future of the apparel industry in India, which is poised to touch $100 billion in the next five years.

Fashion retail in India is set for robust long-term growth due to strong fundamentals of a large and growing middle class, favourable demographics, rising disposable incomes and aspiration for brands. Rapid growth of technology infrastructure will further accelerate this process. Over the years, we have shaped ABFRL into a strong platform to capture future growth opportunities in India. This partnership is a critical component of that strategy”.

Kalyan Krishnamurthy, CEO of Flipkart Group, said, “Through this transaction with ABFRL, we will work towards making available a wide range of products for fashion-conscious consumers across different retail formats across the country. We look forward to working with ABFRL and its well established and comprehensive fashion and retail infrastructure as we address the promising opportunity of the apparel industry in India”.

The deal also marks Aditya Birla’s second attempt to break into the growing e-commerce space in India. It had earlier ventured into online retail on its own through Abof.com in 2015. However, unable to compete with the heavily discounted model of online retail, it shut shop in 2017. The company later brought it back as a private label, and started selling on Amazon and Flipkart.

For Flipkart, the deal means expanding its range of offerings on its e-commerce platforms Flipkart and Myntra, and forging strategic partnerships at a time when the e-commerce space is hotting up in India, especially with the entry of Reliance. The e-commerce company had bought in a stake earlier this year in Arvind Fashions subsidiary Arvind Youth Brands, which owns denim brand Flying Machine, for Rs 260 crore.

Reliance Industries through its retail venture has already raised nearly Rs 37,710 crore by selling an 8.51% stake in Reliance Retail Venture and is investing heavily in the back-end and digitisation to take on the likes of Amazon and Flipkart.

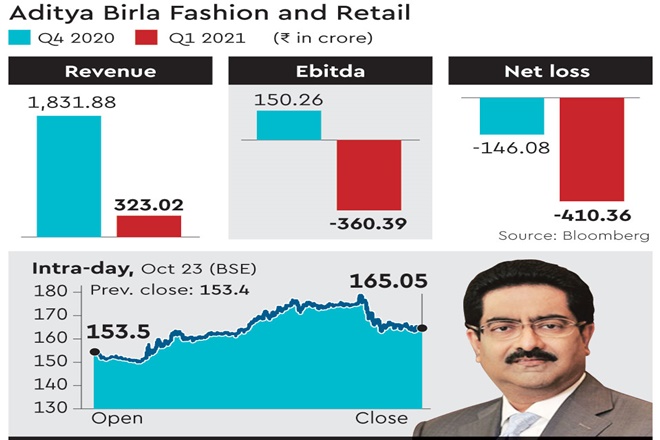

On Friday, Aditya Birla Fashion and Retail shares rose to a seven-month high to close the session at Rs 165.05, up 7.6%, on the BSE. Reacting to the announcement, the stock surged 16.6% in intra-day trade.