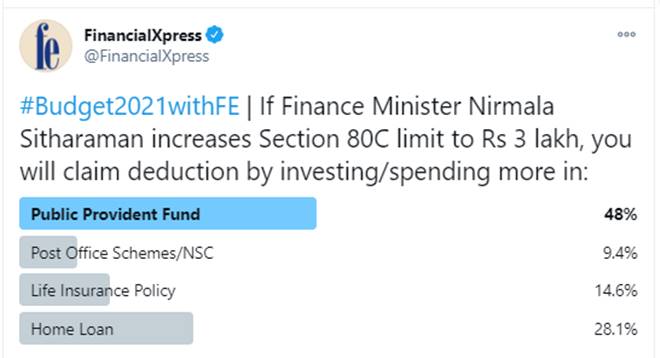

Public Provident Fund (PPF) will be the most preferred option to invest more for claiming tax benefit if the deduction limit under Section 80C is increased in the upcoming Budget to Rs 3 lakh, according to a recent Twitter Poll conducted by FE Online.

As many as 48 per cent participant in the poll said they would claim tax exemption by investing more in PPF if Finance Minister Nirmala Sitharaman increased the Section 80C limit to Rs 3 lakh.

Home Loan, LIC premium payment and NSC/Post Office schemes are some other options where people would like to invest/spend to claim the deduction. Of the total participants in the FE Online poll being conducted in the run-up to Union Budget 2021, 28.1 per cent participant said they would claim the deduction by spending more for home loan repayment, while 14.6 per cent said they would pay more for Life Insurance Policy premium. 9.4 per cent participants would like to invest more in post office schemes if Finance Minister Nirmala Sitharaman increases the Section 80 C limit.

Apart from the above four options, investing in ELSS is also an option for claiming the tax exemption under Section 80 C.

ALSO READ | Budget 2021: Rs 3 lakh Public Provident Fund deposit limit suggested – How will it help? ICAI explains

Under the Income Tax Act 1961, Section 80C is the most popular option to claim the tax deduction. Currently, assessees can claim deduction up to Rs 1.5 lakh under Section 80C by contributing to life insurance premium, ELSS, Employees Provident Fund, annuity plan premium payment, post office small savings schemes, PPF, tax saver FD, Sukanya Samriddhi scheme, Ulip, contribution to LIC annuity plan, investment in NPS, NABARD bond and by repairing the principal amount of the home loan. This deduction up to Rs 1.5 lakh can also be claimed for payment of tuition fees of children.

ALSO READ | Income Tax exemption up to Rs 3 lakh under Section 80C among top Budget 2021 Personal Finance expectations

It is expected that Finance Minister Nirmala Sitharaman will raise the current limit under Section 80 C to Rs 3 lakh. Some experts are hoping that this limit may be raised to Rs 2.5 lakh.