On June 4, RBI revised its CPI inflation forecast for FY2022 upwards by only 10 basis points, to 5.1%, reassuring the market that the accommodative monetary policy stance will continue as long as necessary to revive and sustain growth on a durable basis. However, the MPC meeting-minutes, released on June 18, reveal conspicuous concerns of some members. Since the review, May’s data showed CPI inflation at 6.3%, significantly above the market consensus.

Yet, most economists think inflation simply cannot sustain—the odds are clearly against any breakout, output gap is too large, unemployment rate very high. There’s also this strong belief that inflation expectations have been well anchored. It is like believing the cobra has been defanged; it can now play to the snake charmer’s tune. Will it?

The inflation spurt, in large part, could be due to supply disruptions from the second-wave lockdowns and may wear off gradually with conditions normalizing as happened during the first wave in 2020. This may be so. But the stakes are high: Both monetary and fiscal policies have been deployed to revive growth. The economy cannot afford to apply any brakes. This apart, an inflationary outburst could touch political raw nerves. For the last few months, the RBI Governor has suggested the government should cut taxes on petroleum products, edible oils etc. to cool prices. Yet, so binding are the revenue constraints the government seems to be betting upon producers to absorb the raised costs of inputs. Will they?

A significant distinction is that unlike the first wave in 2020, we are in a different world in 2021. Many advanced economies are experiencing an inflationary bout after more than a decade, at least since the global financial crisis in 2008. Economist Lawrence Summers has relentlessly urged caution about overstimulation ever since US president Joe Biden decided upon a $1.9-trillion Covid relief package. Global financial markets have been edgy last few months but holding on. The Federal Reserve chairman, Jerome Powell, believes though that the underlying inflation dynamics which kept inflation low for a quarter-century remain intact. Should we trust the instinct?

May be! Close next door, China’s factory gate prices shot up to 9% this May, the highest in 12 years, as global commodity prices continued to rise after a six-year gap. To cool down metal prices, nervous Chinese authorities recently decided to release industrial metals from its reserves’ stockpile. Will the move help? We may not know until its actual execution. Another two of our BRICS partners, Brazil and Russia, have raised their policy rate thrice in recent months to check inflation. The most disturbing development of all is the rising international price of crude oil, which is inching menacingly towards $80 a barrel. Will this momentum sustain? Difficult to trust any projection!

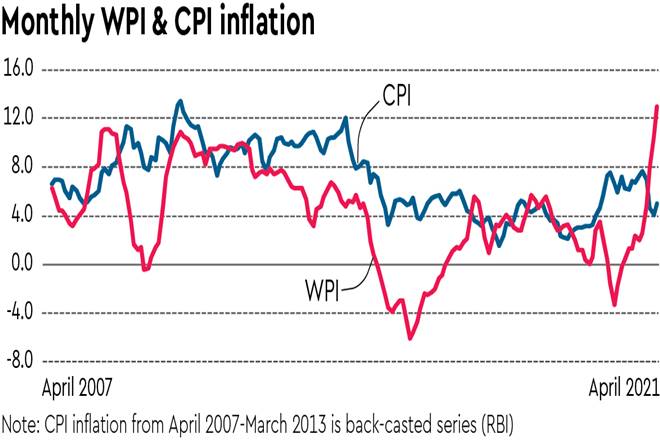

So, what do these developments portend for the inflation outlook in India? What we know with certainty is that wholesale or producer prices have returned to centre-stage of the economy after nearly one decade—India has not seen double-digit WPI inflation rates since September 2011. The question is if this will spill over to retail prices?

Some think the transmission process is already on, visible in high CPI core inflation. But many equally believe the pass-through may remain incomplete because of demand constraint, especially for services. There’s considerable merit in such an assertion.

After all, most analysts, including RBI, have downgraded growth projections for this year, some with downward bias. But there’s one lingering doubt. What if the scarring from Covid lockdowns has indeed dented the economy’s potential and the actual output gap is much smaller?

The commodity price boom is at a relatively early stage. It is not known with surety if this will go bust or turn into another super-cycle. There’s not much merit in looking back at what happened in the UPA-II period. That was a true commodity super-cycle in which oil prices topped $140/barrel in June 2008. Private sector demand was red hot, aided and abetted by loose fiscal and monetary policies with the economy overheating as growth exceeded potential.

Presently, although the fiscal deficit is much larger and monetary policy far more accommodative, economic growth remains below potential with very little private sector demand to support. Thus from a macroeconomic perspective, the risks of a larger spill over to retail prices appear low.

Does that mean firms will have to absorb the rising costs of inputs, denting their margins? This need not necessarily be so! It is well known that companies’ abilities to pass on high costs depend also upon the operating market structure. For example, the scope is very low in a perfect competition setup; in comparison, pricing power is multiplied many times over in monopolistic or oligopolistic structures. In the last seven years, four major shocks—demonetisation in 2016, GST rollout in 2017, NBFC crisis in 2018 and Covid-19 (March 2020 through May 2021)—have mostly damaged the informal sector, including numerous small businesses. However, these helped large firms gain market share.

Many economists have preferred to see this through the lens of formalisation, although there’s no evidence of efficiency or productivity gains. But has the process left us with a more oligopolistic market structure?

What could constitute a cocktail is the design underlying “Make-in-India”, viz. encourage domestic manufacturing with a protective wall of high custom tariff and avoiding cheap Chinese imports. Many contact-based service firms have also piled-up overhead costs during Covid-19; they are seeking opportunities to recoup these too. From an inflation perspective, these configurations pose upside risks. If pent-up demand of consumers suddenly overflows in the forthcoming months, will firms stay put with their prices?

How the interplay between these macro and micro elements evolves will be interesting to observe. As much as we hope for the monsoon to stay the course.